Money and Credit

Money and Credit – Chapter 2 Class 10 Economics (NCERT)

Money and Credit is Chapter 3 of Class 10 Economics (Understanding Economic Development). It explains how money works as a medium of exchange and why it replaced the barter system. The chapter covers modern forms of money, the role of banks in credit creation, and the difference between formal and informal sources of credit. Students also learn how loans can be useful or harmful and why expanding formal sector lending is important. Below are complete notes of this chapter aligned with NCERT, RBSE, and CBSE board exam patterns.

Introduction

Money plays a central role in our daily life. It is used for buying goods, paying for services, savings, loans, and investments. Two key concepts in this chapter: Money as a medium of exchange and Credit as an essential element in economic life. Money has evolved from barter to coins, paper, and now digital forms. Credit means borrowing with the promise of repayment. Its effect can be positive (growth, investment) or negative (dept trap), depending on the terms.

Money as a Medium of Exchange

(a) Barter System

- Goods and services are directly exchanged for other goods and services without using money as a medium.

- Problem: It required double coincidence of wants. It means both people must want what the other is offering, only then exchange can happen. Example: A shoemaker wanting wheat must find a wheat farmer who wants shoes. This was difficult and time consuming, making large scale trade almost impossible.

(b) Modern Money

- Money eliminates the double coincidence of wants by acting an intermediate medium of exchange. It makes buying and selling become independent processes. Example: A shoemaker sells shoes and earn money and then uses this money to purchase whatever he wants.

- Since money acts as an intermediate in the exchange process, it is called a medium of exchange.

Modern Forms of Money

In early times, people used commodities like grains, cattle, and salt as money. Later, metallic coins made of gold, silver, and copper replaced these and became a common medium of exchange.

Currency

Currency refers to the officially accepted medium of exchange in the form of paper notes and coins. It is the most visible and commonly used form of modern money. Features of Modern Currency:

- Definition: Currency refers to the officially accepted medium of exchange in the form of paper notes and coins.

- Difference from earlier forms of money: Not made of precious metals and has no intrinsic value of its own.

- Then why accepted? Because it is authorized by the government. It is legal tender that everyone is bound to accept by law for transactions. In India, RBI (Reserve Bank of India) issues note on behalf of the central government. In India, the rupee is legal tender.

Deposits with Banks

- Definition: Deposits with banks are the money that people keep in their bank accounts for safety and earning interest and can be withdrawn on demand and also earn interest.

- Reason to Use: People receive payments. They don’t need all of it in cash immediately. The extra cash is deposited in bank for:

- Safety: Money remains secure.

- Interest: Money grows over time.

- Convenience: Can withdraw when needed.

- Demand Deposits: Money deposited in bank accounts that can be withdrawn at any time, on demand so, these deposits are called demand deposits. Features of Demand deposits: Safe, provide interest, can be withdrawn at any time and have cheque facility. Demand deposits are also considered money in the modern economy, because they can be used for payments and widely accepted like currency.

- Cheques: Paper instruction to the bank to pay a specific amount from one account to another. Advantages:

- Eliminates need to carry cash.

- Safer for large transactions.

- Widely accepted as payment.

- Role of Banks: Banks provide the platform for deposits and withdrawals and make demand deposits possible. These deposits can be used for cheque payments, enabling cashless transactions. So, modern forms of money currency and deposits are closely linked with the banking system.

Loan Activities of Banks

- Cash Reserve: Banks keep only a small portion of deposits (around 5% in India) as cash to meet daily withdrawal needs.

- Use of Deposits: The larger part of deposits is used to provide loans to individuals, farmers, and businesses.

- Financial Mediator: Banks act as a bridge between depositors who have surplus money and borrowers who need funds.

- Main Income Source: Banks charge higher interest on loans than what they pay on deposits. This difference in interest is the interest is the primary source of income for banks.

- Credit Creation: Money of depositors remains safe, yet the same money is used for providing loans. In this way, banks are able to create credit in the economy. Credit creation means generating more purchasing power in the economy, as the same money serves two people at once – the depositor and the borrower.

Question: What do you think would happen if all the depositors went to ask for their money at the same time?

Answer: Banks keep only a small part of the deposits as cash and give the rest as loans. If all depositors go to withdraw their money at the same time, the bank will not have enough cash to pay everyone immediately. This situation is called a bank run. It creates panic, but in practice, the RBI supports banks with extra cash so that people’s money remains safe.

Two Different Credit Situations

- What is Credit: Credit means taking money, goods or services now and promising to pay later. It can be helpful or harmful, depending on the situation.

- Useful and Harmful Credit: Credit is useful when it increases income and production. Credit becomes harmful when things go wrong, leading to debt and losses.

- Example 1: Salim took credit to buy leather and hire workers for a big shoe order. He completed production on time, made a good profit, and repaid the load. Credit improved his income and business so, it becomes a useful credit.

- Example 2: Swapna took a loan to buy seeds and pesticides. Her crop failed due to pests, she could not repay, and her debt kept growing. Credit pushed her into a debt trap so, it becomes a harmful credit.

Terms of Credit

Terms of credit refer to the set of conditions and rules under which a loan is given. They include the interest rate, collateral (security), documentation required, and the mode of repayment.

- Interest Rate: The extra money the borrower must pay back in addition to the principal amount.

- Collateral (Security): Collateral is an asset (like land, house, vehicle, livestock, or bank deposit) that a borrower gives to the lender as a guarantee for a loan. If the borrower does not repay, the lender can sell the asset to recover the money.

- Documentation Requirement: It is the paperwork that records the borrower’s details and loan conditions. It makes the loan process clear and trustworthy.

- Mode of Repayment: It is the way and time in which the borrower has to pay back the loan, like in instalment or in one lump sum.

Variety of Credit Arrangements

People borrow money from different sources, each having different terms of credit. Credit comes from formal sources (banks, cooperatives) and informal sources (moneylenders, traders, landlords). Formal sources are regulated by the RBI, provide loans at lower interest with fair terms, and help people. Informal sources are not regulated by the RBI, charge higher interest with harsh terms, and often push people into debt.

Supervision by RBI

- The Reserve Bank of India (RBI) supervises banks and cooperatives.

- It ensures:

- Banks keeps a minimum cash reserve out of the deposits they receive.

- Bank do not lend only to big businesses and traders. They must also provide loans to small cultivators, small-scale industries and small borrowers.

- Banks submits regular information to RBI about how much they lend, to whom they lend and at what interest rate.

No Supervision in Informal Sector

- No organization supervises informal sectors.

- They can charge any interest rate, use unfair methods to recover money. As a result of its borrowers often fall into a debt trap.

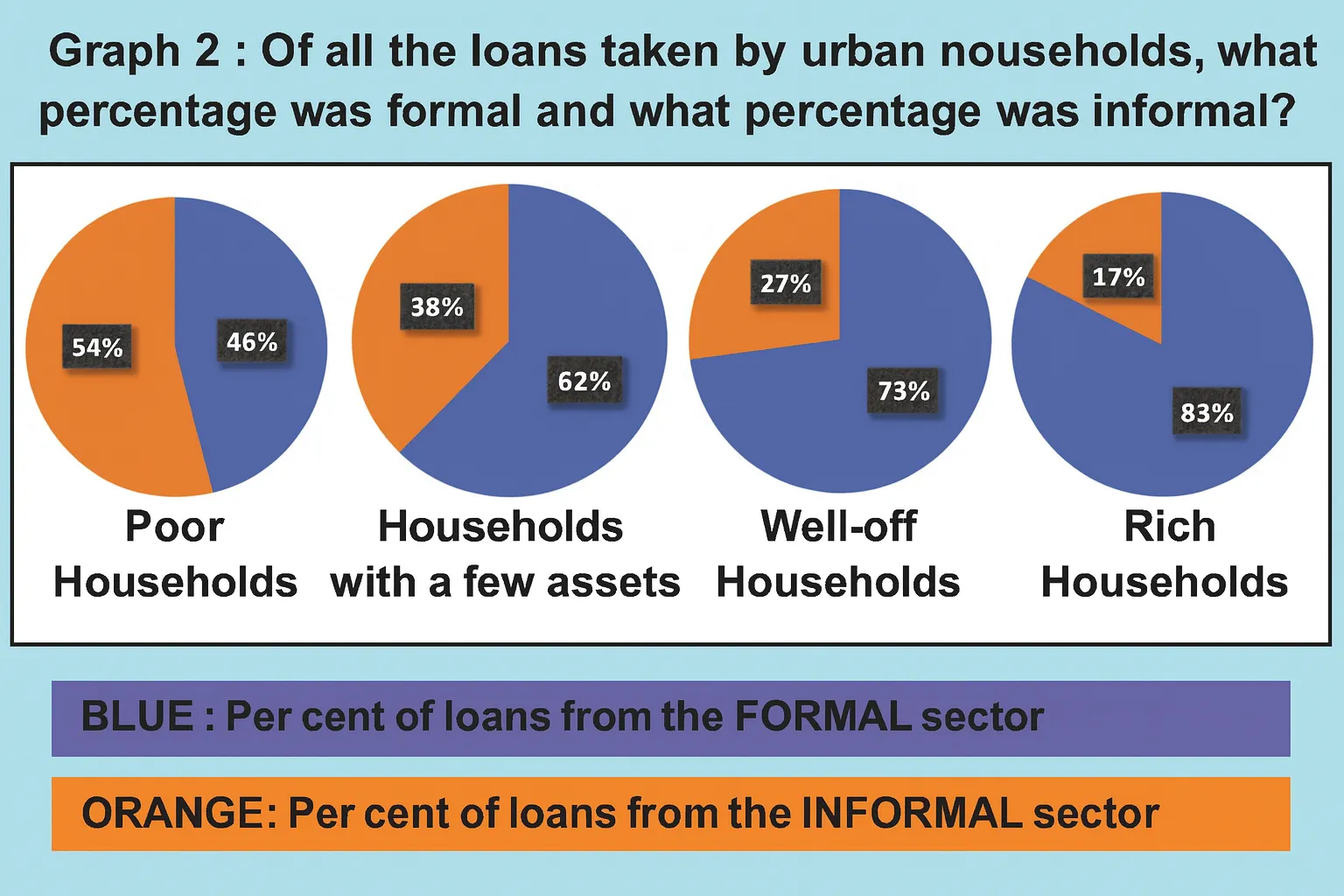

Sources of Rural Credit in India (NSSO Survey 2019)

- Poor Households: Depend heavily on informal sources. About 54% of loans to poor urban households are from informal lenders. Due to it they pay very high interest, often more than their income, leading to debt.

- Rich Households: Borrow mostly from formal sources. About 83% of loans to rich urban households are from formal sources. They get cheap loans with fair terms.

Importance of Formal Sector Credit

- Provides cheap and affordable loans.

- Prevents exploitation of borrowers.

- Helps farmers, small industries, and workers by giving them fair access to money.

- Increases people’s income and spending power.

- Reduces dependence on moneylenders and helps in development of the country.

Key Challenges

- Still, only about half of credit needs are met by formal sector.

- Poor households often cannot get bank loans due to lack of collateral, lack of documents, and difficulty in meeting bank requirements. As a result, they remain dependent on informal sources despite high costs.

Conclusion

- To reduce exploitation and debt traps:

- Formal credit (Banks, cooperatives) must expand in rural areas.

- Access to formal loans should be more equal so the poor also benefit.

- Cheap and affordable credit is essential for inclusive development of the country.

Self-Help Groups for The Poor

A small group of 15-20 people, usually from the same neighborhood, who come together to save money and lend money to each other at very low interest. Most SHGs are formed by rural poor, especially women. Some key points about Self Help Groups (SHGs) are:

- Savings: Members save small amounts regularly and pool them together.

- Internal Lending: Provide small loans to members for needs like seeds, fertilizer, health, or emergencies.

- Low Interest: Loans are given at reasonable rates, much lower than moneylenders.

- Decision Making: Group decides collectively the purpose, amount, interest rate, and repayment terms.

- Bank Linkage: After regular savings, SHGs can take loans from banks in the group’s name.

- Timely Credit: Provide easy and timely loans without collateral.

- Self-Reliance: Encourage savings, reduce dependence on moneylenders, and promote self-employment.

Advantages of SHGs

- Provide timely loans at a reasonable rate.

- Help members overcome the problem of lack of collateral.

- Make poor women financially self-reliant.

- Create opportunities for self-employment.

- Build confidence and leadership among rural poor.

- Meetings also become a platform to discuss social issues like health, nutrition, domestic violence, etc.

Grameen Bank of Bangladesh – A Success Story

- Grameen Bank of Bangladesh is one of the biggest success stories in reaching the poor to meet their credit needs at reasonable rates.

- Started in the 1970s as a small project and by 2018 over 9 million members in 81,600 villages.

- Almost all borrowers were poor women. These borrowers have proved that Poor women are reliable borrowers and can successfully run small income-earning activities.

- Founder Prof. Muhammad Yunus Received the 2006 Nobel Peace Prize. According to him, “If poor people get fair and reasonable loans, their small efforts together can lead to great development.”

Credit and Money CBSE PYQ

Credit and Money RBSE PYQ

Explore Our Quality Contents

All Class 10 Social Science Chapters

All Class 10 Science Chapters

Suggest Links

NCERT Official Text Books

Rajasthan Board Official Site

CBSE Official Site